How to Make Six Figures Selling Cars For a Good Living

Take a closer look at what you’re making in your current job position. If you’re a go-getter and work hard, […] Read More..

Are Prepaid Credit Cards Good for Kids?

One of the best ways to teach proper budgeting techniques to kids is to get them used to using prepaid […] Read More..

Amazon Credit Card Review: One of The Best Credit Cards With no Annual Fee

I am sure you’ve heard of Amazon and the millions of products you can buy for cheap. If you’re trying […] Read More..

Should You Pay Off Debt Or Save Money?

With the elimination of the cap on interest rate charges by our so called Congress, any debt load you’re carrying […] Read More..

Know the Current Tax Deductions for Truck Drivers

When you drive a truck for a living, some of your incurred expenses can be deducted legally based on current […] Read More..

What Does FICA on My Paycheck Mean?

Recently the son of a friend got a job at a local hardware store and he was pissed to see […] Read More..

Top Reasons Why People File For Bankruptcy?

Bankruptcy is not the kind of thing that happens suddenly. One might even say that it can be compared to […] Read More..

Are Prepaid Credit Cards Good for Kids?

One of the best ways to teach proper budgeting techniques to kids is to get them used to using prepaid […] Read More..

Amazon Credit Card Review: One of The Best Credit Cards With no Annual Fee

I am sure you’ve heard of Amazon and the millions of products you can buy for cheap. If you’re trying […] Read More..

Should You Pay Off Debt Or Save Money?

With the elimination of the cap on interest rate charges by our so called Congress, any debt load you’re carrying […] Read More..

What is an Excellent Credit Score?

If you examine the credit score issue closely, it’s obvious banks act like gangs to help determine who or what […] Read More..

401k Loans: Best Way to Borrow Money From Your Retirement Plan and Rules to Follow

Sometimes things happen in life that requires you have money to make it workable. Why have a retirement account when […] Read More..

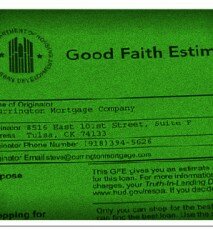

What is a Good Faith Estimate For a Mortgage?

According to the federal real estate settlement procedures act passed by Congress, mortgage lenders are required to give you a […] Read More..

Money Management

Awesome Tips on How to Grocery Shop on a Budget

You desire to save money by doing grocery shopping can be easily accomplished, if you have a set budget and […] Read More..

Money Management

My Girlfriend is a Financial Wrecking Ball

In my lifetime, this is my second time been in love, but she lacks basic knowledge about how to keep […] Read More..

Money Management

10 Proven Kid Friendly Jobs to Get Them Off Your Couch

The best skill you can teach your kid is how to find inventive ways to earn money legally. It’s never […] Read More..

Money Management

3 Proven Good Money Habits You Can Teach Your Kids

Before you know it, I found myself living alone and now an adult. I went on to established several businesses […] Read More..

How You Can Buy a Foreclosed Home With Cash

Unfortunately another person’s misfortune is someone else fortune. A car accident produces horrific scenes, but it keeps the injury lawyers […] Read More..

Ways to Come up With Additional Downpayment to Buy a House

In some parts of the country, the good old days of higher real estate prices is back with a vengeance. […] Read More..

Apartment Buildings: Some Awesome Tips You Ought To Know About

Nowadays, apartment rental is a booming business because of the foreclosure crises. As more families lose homes to mortgage bankers, […] Read More..

Is It Better to Rent an Apartment or Buy a House?

After a few days of living in my own home, I found myself confronted by repairs that my former landlord […] Read More..

One Bad Tenant Can Ruin Your Building: Use This 5 Steps To Keep Them Away

Having successfully purchased your own small or large apartment building, sooner or later you’ll have a vacancy that needs to […] Read More..

Single Family Homes Vs. Multi Family Homes: Which is Better For First Time Home Buyers?

Buying real estate is becoming vogue again, most people are wondering what type of housing unit to purchase. Our comparison […] Read More..